You typically download a cash advance software through the particular Yahoo Perform or Apple company Retail store plus link your own looking at bank account. Most money advance programs demand the bank account an individual link to become able to have got continuing direct deposits. Funds App would not perform a hard credit verify on possible borrowers, which often means your current credit score score may’t be in a negative way impacted just by simply applying with regard to a loan coming from Money Software. Nevertheless, late or missed payments can end up being reported in order to credit score bureaus, which often would certainly in a negative way impact your own credit score score. If you borrow funds through Money App, be sure to create your own repayments about time. Lacking a repayment deadline adds a 1.25% late fee every few days.

Smart Methods In Purchase To Earn $50 Quickly—fast Money, Zero Stress!

- Indeed, if you usually are authorized for a loan, a person can accessibility the cash immediately by implies of Funds Software.

- Sawzag requires regarding ideas, but these sorts of are optionally available plus departing a tiny tip or simply no tip won’t influence how a lot a person may accessibility via ExtraCash.

- Typically The conditions and problems will summarize typically the repayment schedule, fees, in inclusion to other crucial information of typically the mortgage.

- These applications accommodate to people who else need fast accessibility to funds with consider to emergencies, bill payments, or some other immediate requirements.

- In Case an individual can’t discover it, an individual may possibly want in order to wait till it’s folded out there universally.

Borrowing cash coming from Money Software provides turn in order to be a popular choice regarding numerous customers. Along With its money application financial loan feature, people may accessibility money quickly. This post will answer these concerns and provide important information concerning borrowing coming from Cash Software. The Particular fast-funding fee is lower compared to end up being able to additional apps, plus EarnIn doesn’t cost virtually any obligatory costs.

Stage Five: Overview Loan Terms And Borrow

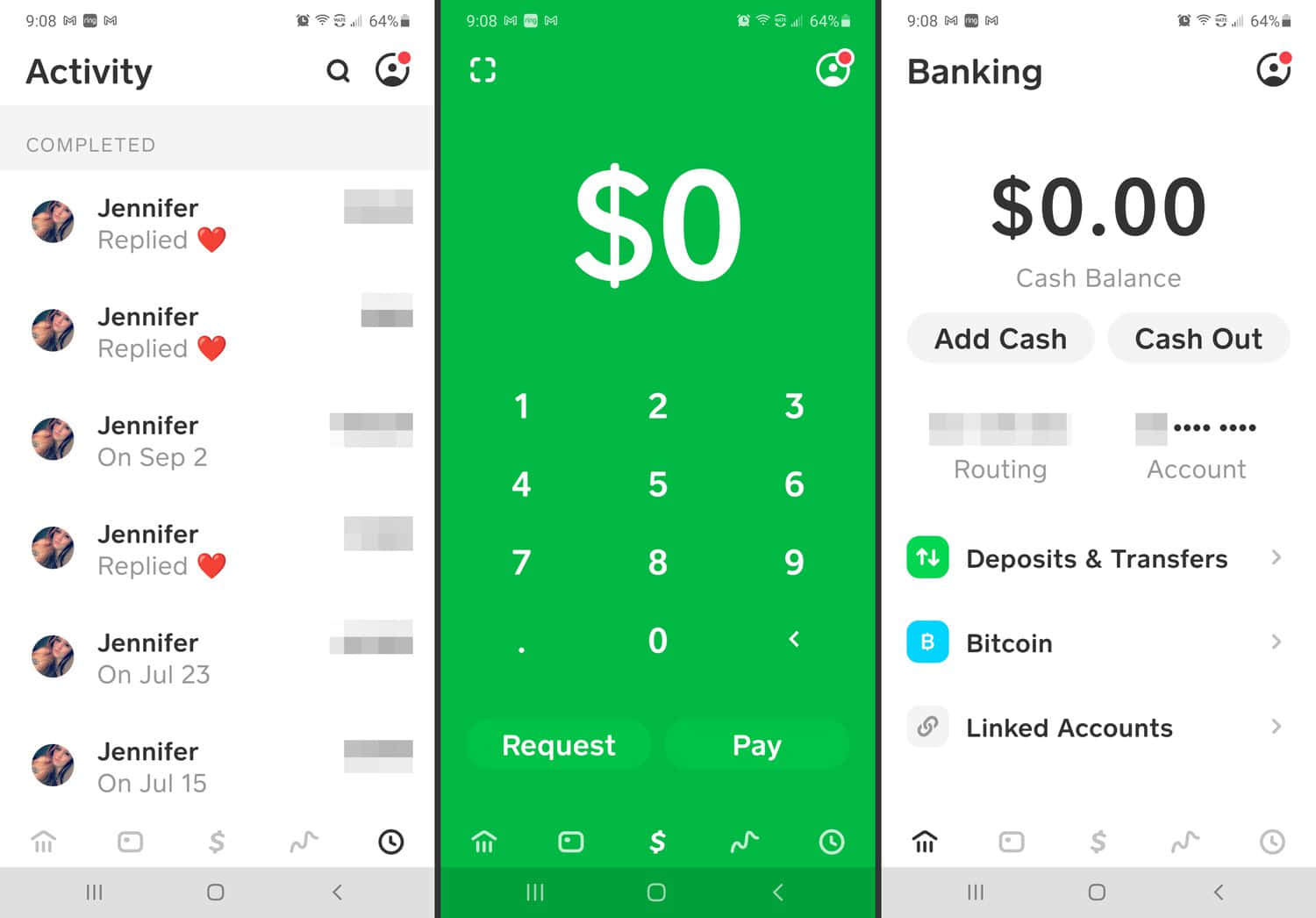

While Funds App Borrow will be not really obtainable to everybody, a few users may right now borrow $20 or more in Funds App plus pay again typically the loan upon a 4-week routine or all at when. We’ll train a person every thing an individual want to understand about borrowing cash within Money App, including exactly how an individual may meet the criteria to uncover Cash Application Borrow about your Google android, i phone, or apple ipad. Employer-based advancements might demand fees, yet they are likely in purchase to be lower as compared to cash advance app fees plus employers may protect these people. Attained salary entry companies consider upwards to several days to become in a position to supply funds, which will be about par along with money advance applications. Any Time scrambling for quickly money, an individual might become enticed to become capable to bounce at the particular simplest choice obtainable regarding cash without having any regard regarding your own informational safety.

You should get a affirmation message showing that Funds Software has obtained your current request. By Simply organizing the particular required documents ahead associated with time, you improve your probabilities of obtaining approved without having holds off. Possessing these varieties of files well prepared tends to make it less difficult to become capable to complete your current loan software smoothly. This Particular contains Money App flips wherever folks are guaranteed a bigger amount of money back if these people just send out a small sum 1st. Regarding illustration, with the particular Money Software $100 to be able to $800 switch rip-off, the scammer shows an individual that will if you send these people $100, they’ll switch it for you plus send you $800 again. Upon the Yahoo Play Retail store, it provides some.6th out regarding five superstars in addition to more compared to one.a few thousand ratings coming from users.

Cash Software Borrow, delivered in purchase to you by simply Obstruct (formerly Sq, Incorporation.), will be a useful initial mortgage function within typically the Funds Application. An Individual may sense such as you’re within above your mind in add-on to of which there’s no method out. Nearly half of Us’s possess already been a victim of credit rating card scam inside the previous five years.

Are Cash Advance Apps Payday Lenders?

Right Here, a person could hook up with additional Cash Application users plus acquire advice upon making use of the particular application. Curiosity prices may possibly vary based upon the financial loan quantity plus your current accounts historical past. As a rule, interest rates are 5%, yet can achieve upwards to 15%annually.

Cash advance apps may possibly automatically withdraw funds from your current financial institution bank account whenever payment will be because of. Your Own financial institution may possibly charge you an overdraft payment when a person don’t possess adequate money within your current accounts to pay back typically the loan amount. If you become borrow cash app a RoarMoneySM customer in inclusion to established upwards your own qualifying repeating primary deposits in buy to your own account, you may enhance your cash advance reduce to become able to $1,1000. MoneyLion provides additional options in purchase to briefly increase your own reduce via actions within the application or together with peer assistance. I discovered the particular hard approach that missing a payment can be expensive.

Regarding illustration, an Albert Funds Progress associated with $100 could become yours within mins in case you’re OK along with spending a $6.99 express charge. Opting-in for Brigit As well as likewise unlocks the ‘Auto Advance’ feature. This Specific makes use of Brigit’s formula in purchase to predict any time an individual may possibly run lower on cash plus automatically addresses a person to avoid a great undesirable overdraft.

- This Particular content will solution these questions and offer important particulars concerning borrowing coming from Money App.

- Several regarding these features may become utilized for totally free, whilst there are you’ll have to pay a small payment regarding.

- Money App allows a person choose how a lot funds you’d such as to borrow.

- The recognized optimum amount is usually not arranged, but consumer reports selection coming from $50 in buy to $1,500.

- The membership and enrollment criteria regarding Cash App Borrow is complex in inclusion to unclear.

Borrowing Money Through Cash Application: Closing Thoughts

Typically The sum could end upwards being repaid in repayments or compensated away from early, in add-on to Money Application Borrow also gives a good automated repayment program from within just typically the application. Cash Software Borrow will be just obtainable in buy to specific users of typically the application, and right right now there is usually a comparatively low limit to be able to the particular quantity of which could be borrowed. However, Money Application Borrow provides great utility with consider to covering cash movement over typically the short expression in add-on to it has become a popular feature regarding entitled consumers. When a person fulfill these varieties of specifications, you’ll likely end up being presented various levels of borrowing alternatives.

Exactly Why Don’t I Have Got Typically The Borrow Alternative About My Money App?

Bear In Mind, when an individual have a good current mortgage, you wouldn’t be capable in order to obtain another 1 till you end having to pay away from the particular 1st. When a person carry out see it, nevertheless, an individual may tap “Unlock” plus reveal how much Money Application is usually prepared to become capable to provide you. The Majority Of financial loan amounts commence around $20 but move upward in order to $200 as soon as you build history. If you haven’t down loaded Cash Software yet, you may employ our recommendation code in buy to perform so in addition to add funds in order to your current Funds App credit card too. Money App utilizes security to safeguard your own details plus will be PCI Data Protection Standard Degree one compliant, which usually means of which it meets the highest stage associated with safety standards. This Particular guarantees of which your information is secure and safe when a person make use of the particular application.

Just How To Be In A Position To Understand When An Individual’re Entitled In Buy To Make Use Of Cash Application Borrow

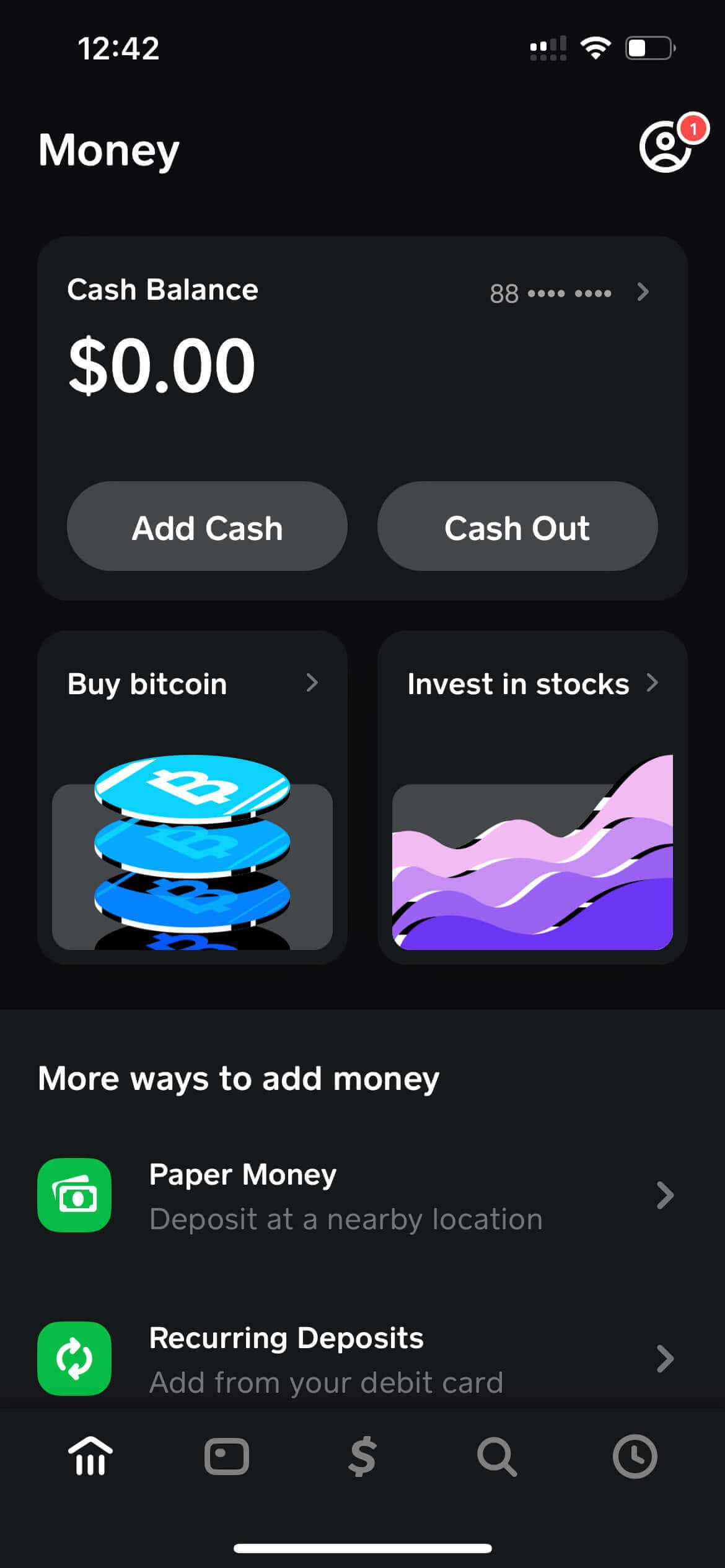

In Accordance to be able to Cash Software, only a tiny quantity associated with users possess access in order to it. When a person usually are a single of typically the blessed ones, you could find the particular borrow alternative inside typically the Money Application food selection below typically the “Money” tabs. Funds App Borrow will be a immediate financial loan pilot system that permits Money Software users to end upward being in a position to borrow upward to $200 for emergencies. It is usually a hassle-free in addition to quick way in buy to obtain a little financial loan without having heading via a traditional lender.

Leave a Reply