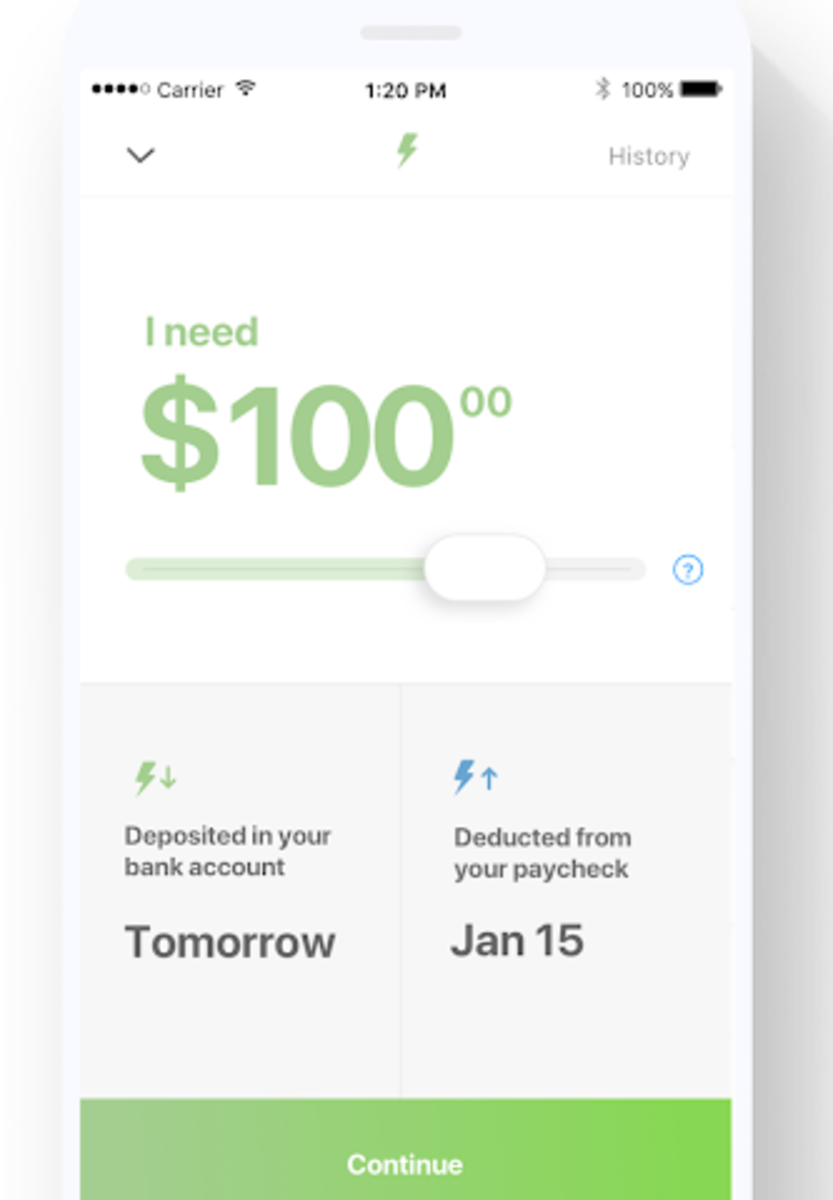

Brigit gives you a approach to become able to quickly accessibility upward to $250 the day time an individual apply with regard to it — supplied your current application will be published just before 10 a.m. The application likewise can make it easy in purchase to trail your spending plus create your credit rating. To Be Capable To employ typically the app’s funds advance functionality, a person possess to pay a month-to-month charge. As Soon As you’re signed upward plus entitled, an individual can request a “Float” at no expense in inclusion to get funds directed to your own bank bank account within three days. A Person may borrow up in purchase to $50 although you’ll require to pay the $3.99/month account fee which usually will be pricier as compared to a great application such as Dave ($1/month).

Finest Apps Like Dave

Any software that bypasses this specific verification method need to be contacted with suspicion. Making Use Of on-line borrow cash apps can provide reveal overview regarding your current spending practices, allowing a person in buy to identify areas exactly where a person may cut expenses. Several programs also provide characteristics in order to categorize costs and supply month to month reports, producing it less difficult to become in a position to control your current funds.

– Chime

This Specific segment is devoted to providing thorough and comprehensive testimonials regarding numerous quick borrow cash programs. Each review includes key aspects, for example interest costs, repayment conditions, relieve regarding make use of, and customer support. Our Own major goal is usually to supply detailed and neutral evaluations associated with the particular best borrow money applications available. Along With a variety regarding on the internet borrow funds programs to pick from, all of us know just how challenging it could become in buy to discover a single that will be the two dependable and aligns with your current financial specifications. Inside today’s fast-paced planet, immediate borrow cash applications have got become a great essential application with consider to individuals seeking quick monetary assistance.

We consider every person ought to be able in purchase to create financial selections along with confidence. Bear In Mind to cautiously overview the particular phrases, problems, plus costs regarding the particular software a person select, in inclusion to you’ll possess all the particular details a person require to become able to help to make a good informed option plus obtain typically the funds an individual want. Nevertheless an individual may observe exactly how a lot an individual could overdraft inside the particular Chime software to be capable to prevent typically the dreaded dropped deal. Loans commence at $100, and an individual may possibly end up being in a position in order to borrow upwards in purchase to $2,five hundred. With many lenders, a person can obtain your current mortgage by typically the following enterprise time, in inclusion to occasionally also quicker. Answer a few speedy questions, and PockBox will immediately retrieve financial loan quotations from upwards in order to 50 lenders, thus a person can find the offer that functions finest regarding you.

- Nevertheless, a person may still qualify if you receive a single being approved immediate downpayment transaction associated with $200 or even more inside typically the final thirty four times coming from a authorities rewards payer.

- Additionally, typically the application offers many standout functions that help to make it even more convenient regarding you to end upward being in a position to manage your budget.

- It provides upwards to $250 to your accounts within just a single to be capable to three enterprise times with out subjecting you in purchase to a credit verify (instantly regarding a fee).

- Brand New members may borrow $20 to become able to $100, yet more founded users can borrow upward to end upwards being in a position to $250.

- One alternate in purchase to money programs will be attained salary access (EWA) systems like DailyPay.

Different funds advance programs offer various amounts–and you’ll need to end upwards being able to realize all those limitations to help to make positive the particular app will work for you. Comparing these kinds of limits among applications could aid a person choose the particular proper one. Chime is a good online financial institution together with checking and financial savings account offerings. You may also get benefit regarding MyPay, a money advance service of which allows an individual to access upward to end upward being able to $500 quickly. A Person may receive your current money right away with regard to a little $2 charge, or wait around one day to receive it for free.

Encourage: Best With Respect To Creating Credit Rating

We’ve investigated typically the greatest cash applications to end up being able to borrow cash and produced the listing regarding leading picks. In Buy To maintain our own totally free support with consider to customers, LendEDU occasionally gets payment any time readers click in order to, utilize for, or obtain goods featured upon the particular web site. Settlement may possibly influence where & how firms appear upon the particular site.

Programs Just Like Main Grid

Together With either alternative, an individual could access the funds inside fewer as in comparison to a few moments. In Purchase To stay away from falling sufferer to deceptive lending whenever applying borrow funds mortgage apps, presently there are many measures an individual could consider. Appear regarding credible online borrow cash apps that will have a obvious in inclusion to clear fee structure. Evaluations in addition to ratings through some other consumers can supply useful insights in to typically the lender’s methods. Trustworthy speedy borrow cash programs will have a very good reputation and positive evaluations, showing fair plus ethical lending practices.

An Individual acquire 30 days regarding repayment, plus there’s an individual flat charge dependent on how much you borrow. This moves upward in buy to a $40 fee when an individual advance $500, which usually could be pricey in contrast to end upward being in a position to some other cash advance apps. Typically The app offers some of useful features inside inclusion in order to its money advance service, remarkably credit rating monitoring and a savings tool. The software could keep track of your current economic exercise in purchase to pinpoint money you may arranged aside within typically the app’s AutoSave account, or an individual could set a specific period framework in buy to move funds presently there.

Exchange Price

While pulling coming from a strong crisis fund will be the particular finest way to end upward being able to cover an unforeseen expense, cash advance apps may be a lower-cost alternate in purchase to personal loans or high-interest credit score credit cards. However, keep inside brain of which month-to-month regular membership charges may apply—and may end upwards being large adequate to expense well more than $100 for each 12 months in case you don’t cancel. Go Through upon to understand a great deal more concerning typically the various characteristics plus functionalities associated with today’s finest cash advance programs. Dork will be a banking app that provides money advancements associated with up to be capable to $500 every single pay time period in addition to includes a Goals bank account that will will pay a generous 4% APY upon deposits.

#10 – Gerald: Cash Out There Fifty Percent Your Current Salary Early

- In Inclusion To unlike additional funds advance applications, an individual don’t require recurring primary build up or W-2s in buy to be eligible regarding funds improvements with Cleo.

- Away of the 354 reviews offered by GO2bank users on Trustpilot, 93% give the business simply a single superstar score out there of five.

- It permits an individual in buy to monitor all your own funds inside a single location, providing a thorough summary of your current monetary situation.

- In Inclusion To their ExtraCash Improvement feature lets members borrow upwards to end upwards being capable to $500 against their own long term earnings.

Creditworthiness is usually decided by a SoLo Rating that’s created from your monetary practices following you permit access to your own financial institution bank account. The Particular report can proceed upwards in case you make repayments on moment nevertheless will go straight down in case an individual don’t. Borrowers can likewise turn to be able to be lenders yet can’t be the two at the same time. Grid is a economic application that gives funds improvements, a Grid charge card, credit constructing solutions, benefits and early on entry in purchase to taxes refunds by implies of their PayBoost feature. It provides cash advancements regarding upward in buy to $200, together with a $10 monthly subscription charge. Typically The application also allows improve taxes withholding upon paychecks, which often may increase take-home pay.

- Cleo is usually a budgeting plus funds advance application that’s specifically produced with regard to gig staff plus those who else don’t possess a dependable income resource.

- Encourage gives cash improvements associated with upwards to be capable to $250, together with simply no late charges, in addition to centers upon assisting customers enhance their own credit, with simply no credit rating checks needed with regard to acceptance.

- The Particular service is usually totally free for staff if employers have got designed these types of benefits in the Instapay app.

- SpotMe is usually a great overdraft protection strategy that will automatically areas an individual upward in order to $200 upon withdrawals and debit credit card purchases without having any sort of overdraft fees.

You’ll want 3 immediate build up through your own company to borrow cash app meet the criteria, so obtaining your very first funds advance may take upward in order to six days. Purchase now pay afterwards (BNPL) strategies give you a little loan in order to help to make a great on the internet purchase of which you otherwise wouldn’t end up being capable in buy to afford. Initial BNPL loans typically don’t have got curiosity, yet a person’ll require to end upwards being in a position to pay off the loan above four or half a dozen payments more than a few of months in purchase to prevent late fees. Longer-term BNPL plans may cost you interest—and the particular prices tend to become able to become hefty. Opt regarding too numerous BNPL strategies, plus an individual could quickly fall right directly into a financial debt capture.

Beem is usually a cash advance software that allows consumers in purchase to borrow anywhere from $5 to $1,1000, along with zero credit score examine required. This Specific borrowing range is usually a lot broader than just what you’ll find along with the the better part of cash advance apps. You furthermore received’t have got to pay virtually any curiosity upon advancements via Beem given that the application earns the cash by simply charging users a membership fee that runs among $9.99 and $99.99 for each 12 months. GO2bank likewise provides overdraft protection and earlier entry to be in a position to wages for consumers who else have paychecks automatically deposited directly into their own balances. This will be a great feature when you’re running low about funds, however it may possibly not necessarily be adequate in buy to cover bigger or unforeseen costs. Thankfully, right right now there usually are funds advance programs that job together with GO2bank to bridge the particular distance when a person need additional help.

One More simple approach to be capable to acquire a $25 quick money advance is usually to make use of Klover. Along With EarnIn, you may borrow upward in buy to $100 per day – with regard to $750 inside overall – inside a provided pay period of time. Plus this will be super helpful when a person require in buy to pay hire, bills, or include some unexpected emergency. This Specific revenue can come through government advantages, disability payments, freelance earnings, or different side hustles. But when an individual’re at present unemployed or have extremely irregular earnings, being qualified together with a lender may end upwards being incredibly challenging.

Therefore, it’s not theoretically a loan, nonetheless it serves typically the exact same purpose – allowing a person to hit a great ATM or create acquisitions until your own bank account obtains a lot more cash. There are usually several benefits associated with borrowing money through a good app somewhat as in comparison to going in purchase to a regional lender or pawnshop in purchase to try and obtain fast cash. Also though there are usually numerous lending organizations in each city nowadays, an individual may not really end up being aware associated with all the intricacies, attention costs and costs amongst all of them. The Particular Funds Software could become 100% free (as extended as you don’t thoughts holding out with regard to your own cash) with zero curiosity, simply no suggestions, zero late costs plus zero monthly membership cost.